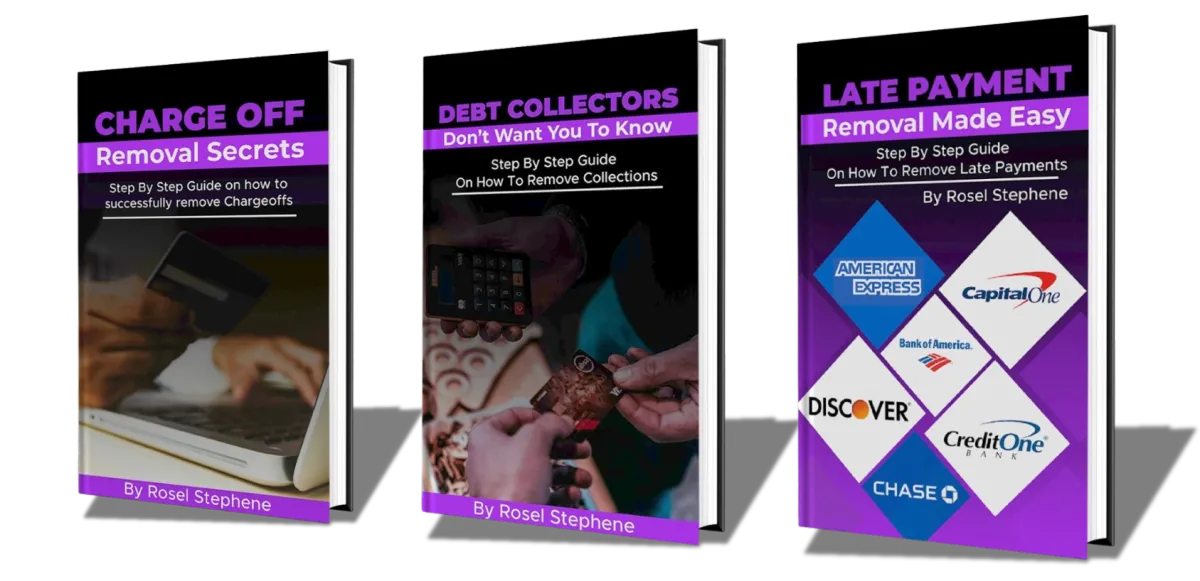

Erase Negative Items USING OUR Credit Comeback Bundle

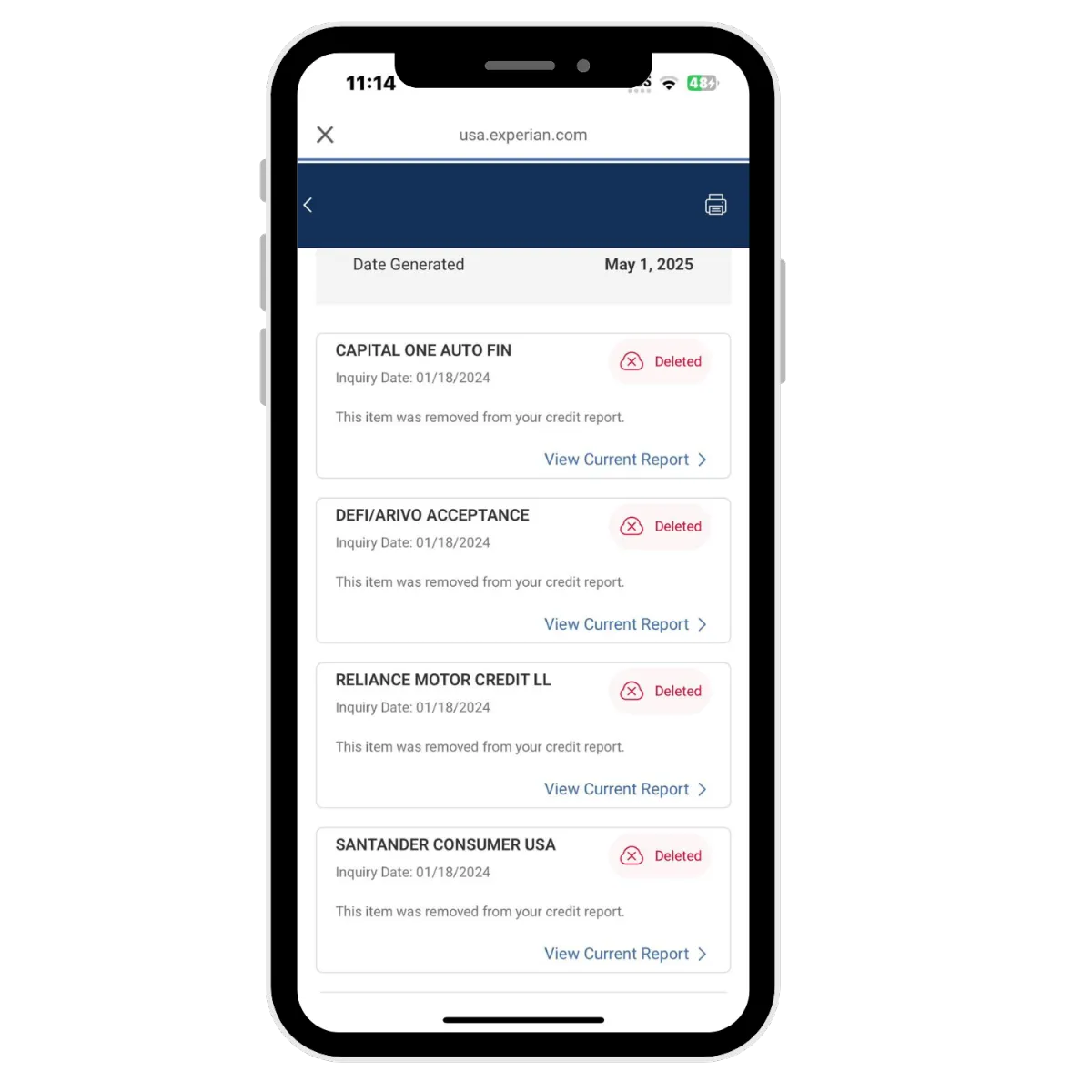

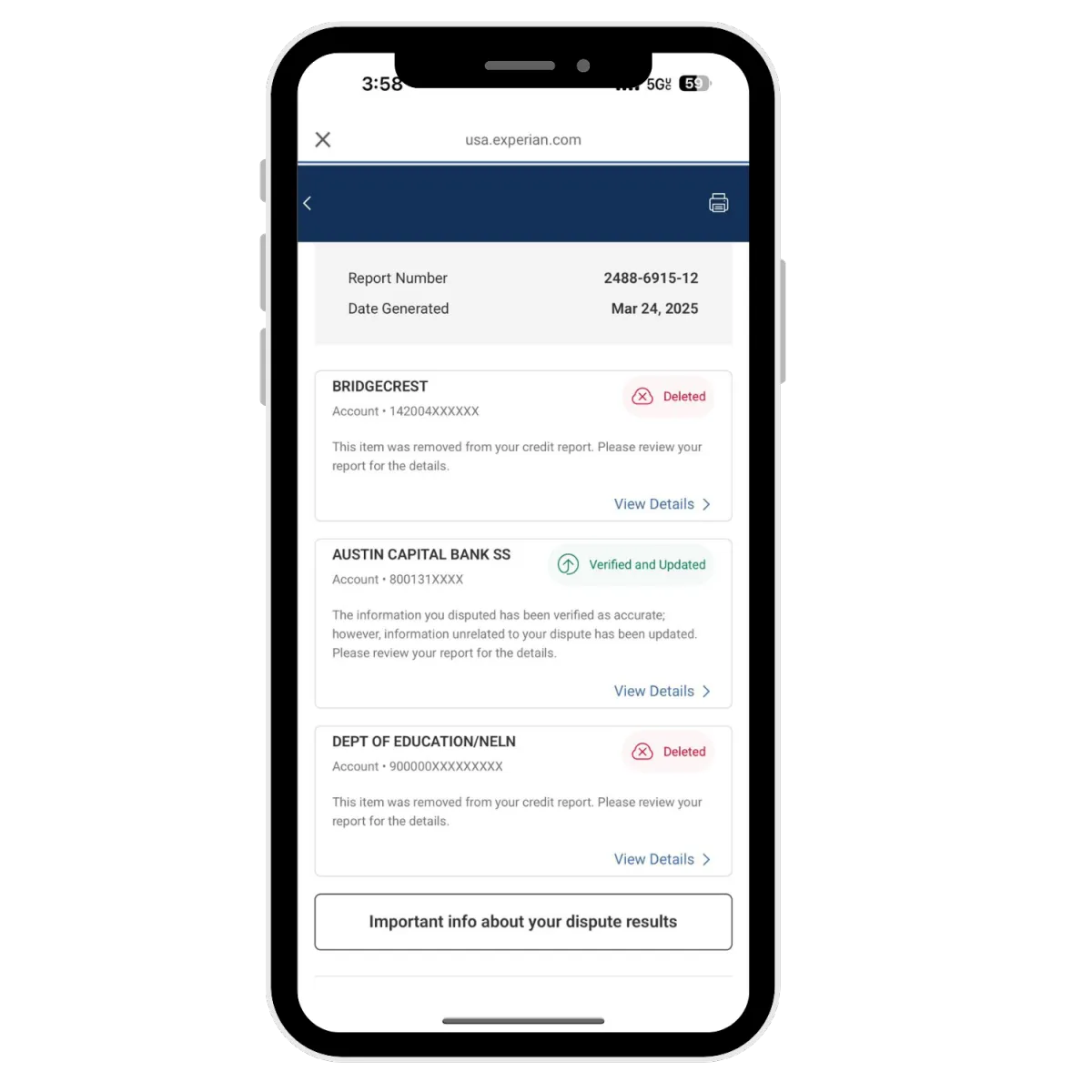

Learn how to remove collections, late payments, and charge-offs

step-by-step, with proven strategies.

Only $197 for the complete 3-guide bundle!

Limited Time-offer

The Problem:

Debt collectors blowing up your phone?

Late payments dropping your score?

Charge-offs you can’t seem to get rid of?

The Solution:

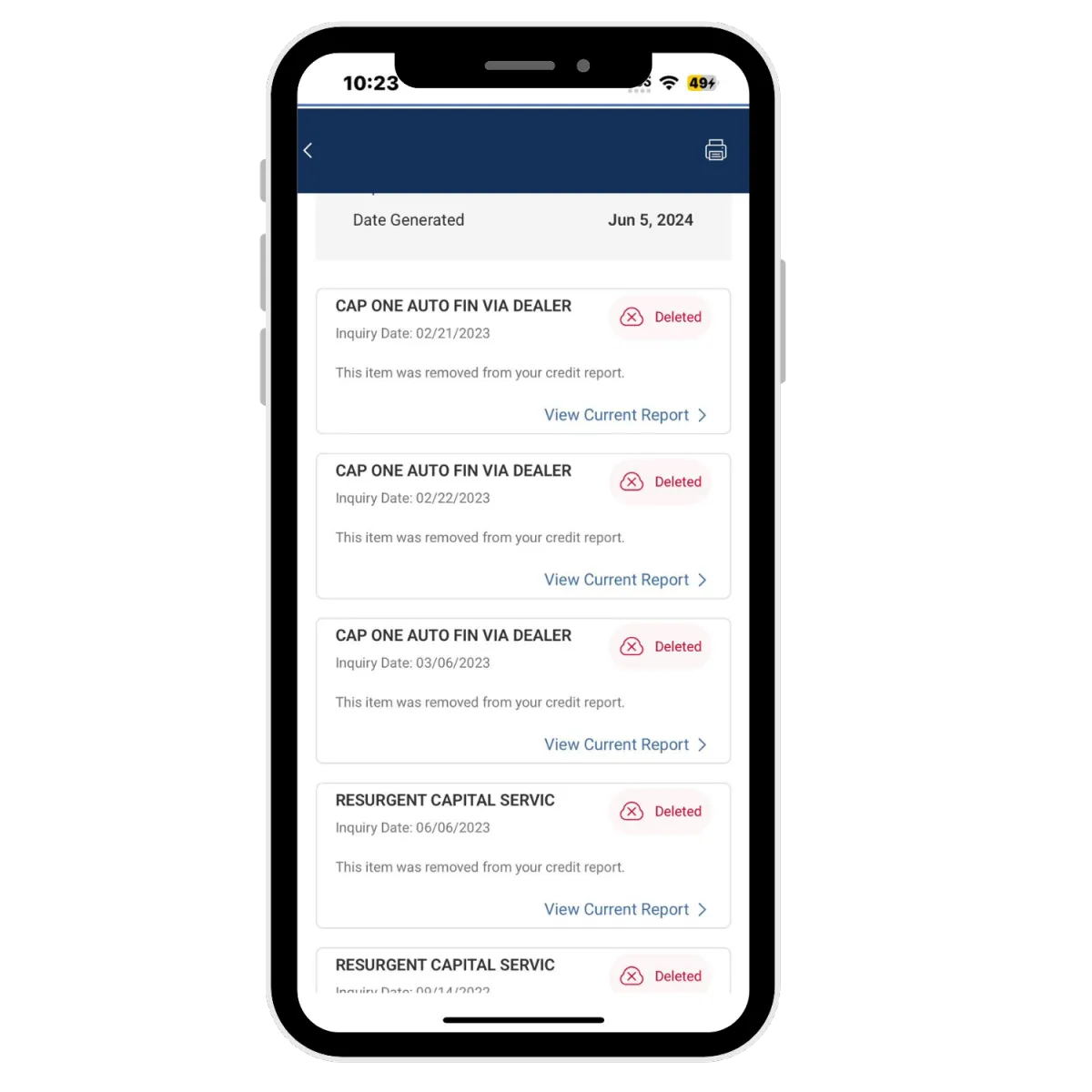

Start with the Credit Comeback Bundle, I'll show you step by step how to remove collections, late payments, and charge offs-using simple letters and the laws that protects you. Everything broken down so you can do it yourself and see real results in as little as 90 days.

WHAT YOU’LL GET INSIDE THE Credit Comeback Bundle:

3 step by step eBooks that walks you through Removing Collections, Late Payments, & Charge Offs in as little as 90 days.

Comes with ready to send letters just fill in your info and mail them.

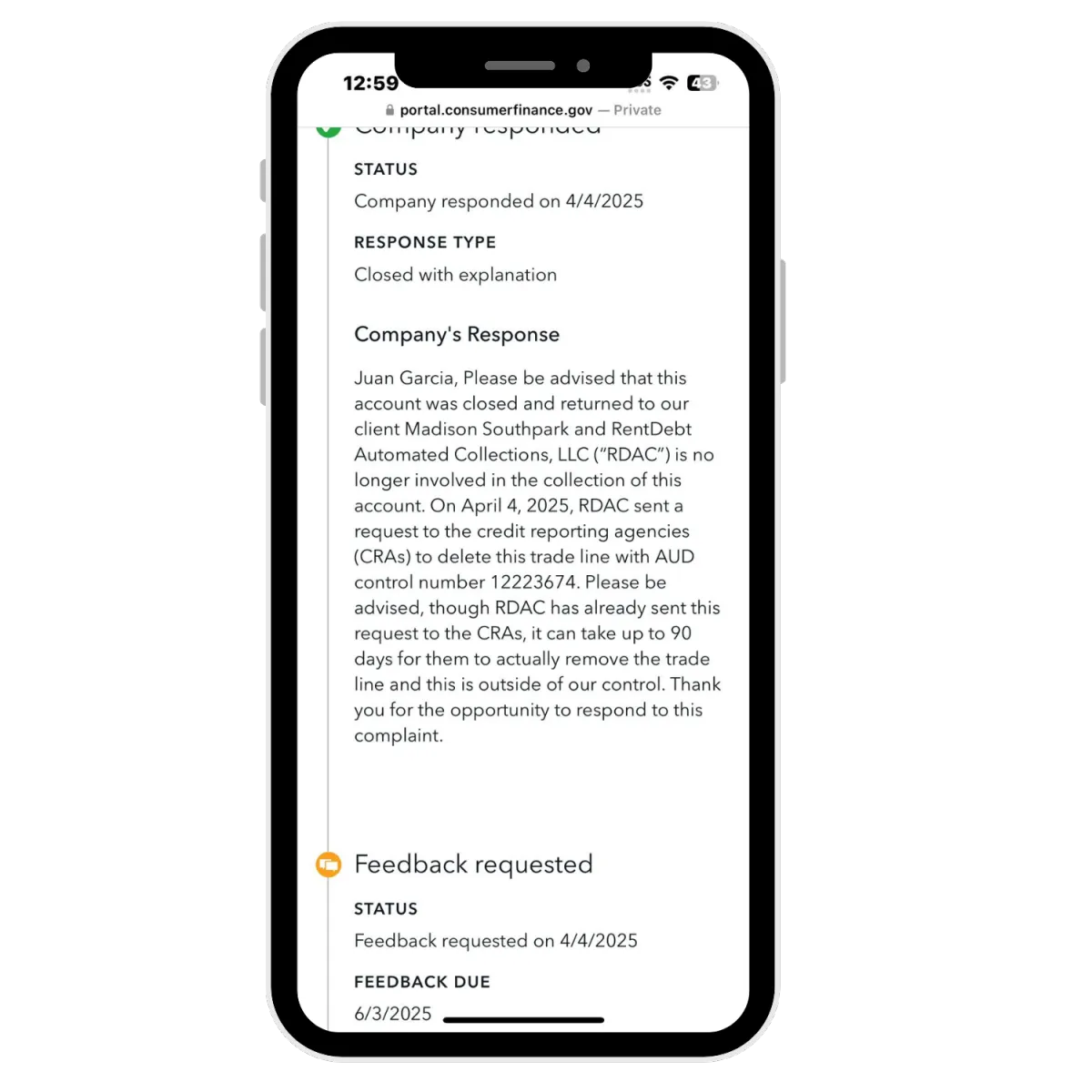

Learn how to file complaints with the CFPB the right way when companies dont follow the Law.

Everything is broken down in plain English- no confusing legal talk, just real steps that work.

Debt Collectors Don’t Want You to Know

Late Payment Removal Made Easy

Charge-Off Removal

Secrets

All 3 guides for just $97 — delivered instantly to your email.

Why This Works

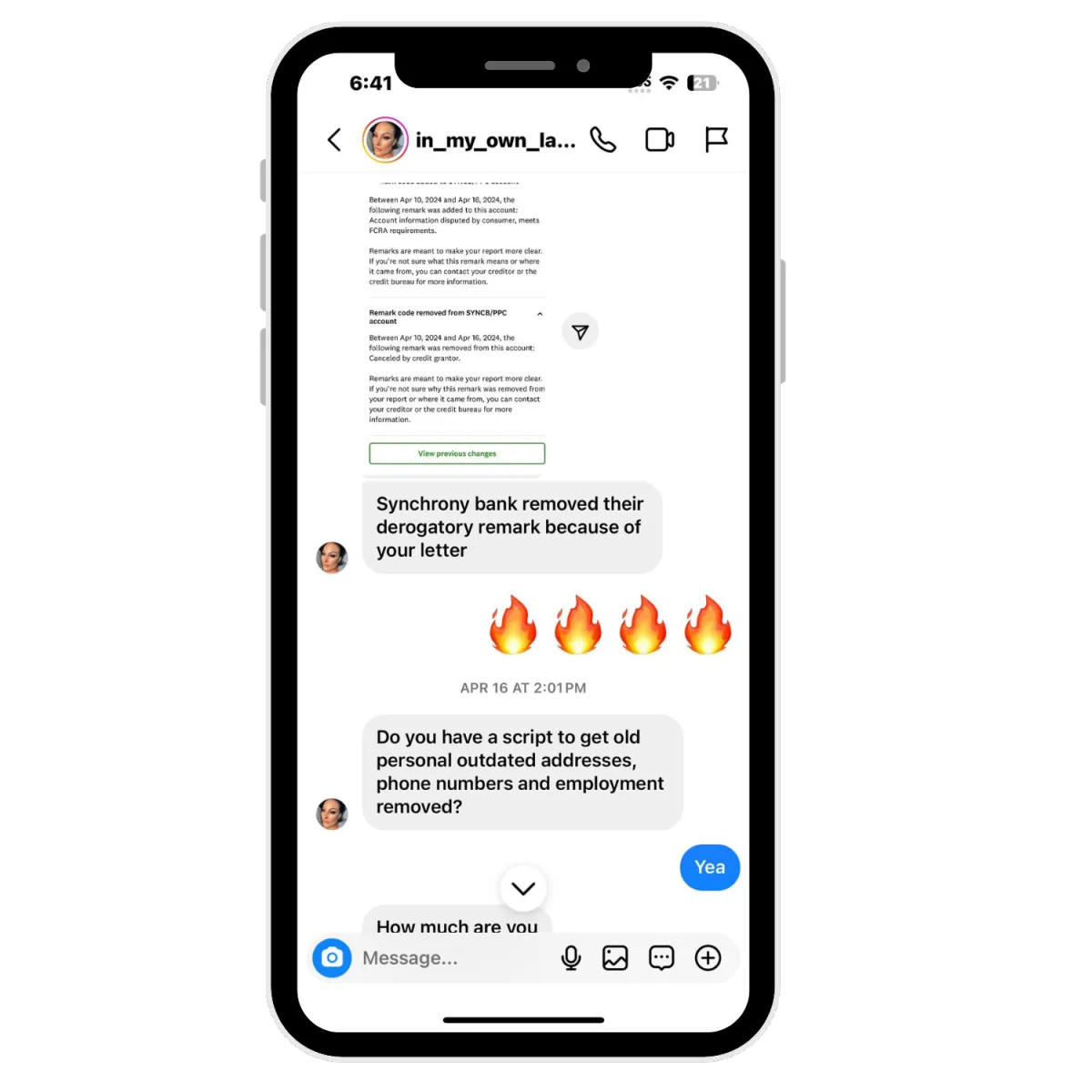

Written by Rosel Stephene, an experienced credit repair expert who’s helped hundreds restore their credit.

Includes real dispute letter strategies and insider tips that actually work.

No confusing legal terms — just simple, actionable steps you can take today.

What’s Holding Your Credit Back Is Costing You

Every Single Day…

Collections still haunting you? Every day they sit on your report, your chances of approval sink lower.

Late payments dragging your score down? Lenders see you as “high risk” — keeping you locked out of funding.

Charge-offs killing your profile? Without removing them, you’ll keep paying higher interest (if you even get approved at all).

💡 With the Credit Comeback Bundle, you’ll learn how to erase the exact marks that are keeping you from approvals, funding, and financial freedom.

⚠️ Don’t wait — every month you delay means another denial, another loan you can’t get, another opportunity you lose.

👉 All 3 guides are yours today for just $97 — delivered instantly to your email.

Frequently Asked Questions

What exactly is included in this e-book bundle?

You’ll receive three step-by-step guides:

- Debt Collectors Don’t Want You to Know – How to remove collection accounts.

- Late Payment Removal Made Easy – Proven strategies to delete late payments.

- Charge-Off Removal Secrets – How to successfully remove charge-offs from your credit report.

How will I receive the e-books after purchase?

Once you complete your purchase, the e-books will be delivered instantly via email in digital format (PDF). You can access them on any device—phone, tablet, or computer.

Will these e-books repair my credit instantly?

No. These guides provide strategies and proven methods, but results depend on your individual credit situation and consistency in applying the steps.

Do I need prior credit repair knowledge to use these guides?

Not at all! Each e-book is written in simple, step-by-step instructions so anyone—even beginners—can follow along.

Are the methods inside legal?

Yes! All strategies are based on consumer rights under federal laws such as the Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA).

Can I use this bundle if I already hired a credit repair company?

Absolutely. You can use these strategies alongside a professional service or on your own for extra control and faster results.

What if I don’t get results?

Results vary, but applying the steps consistently increases your chances of success. Remember, credit repair is a process—not an overnight fix.

Do you offer refunds on digital e-books?

Due to the instant delivery and digital nature of this product, all sales are final. However, we’re confident you’ll find massive value in these guides.

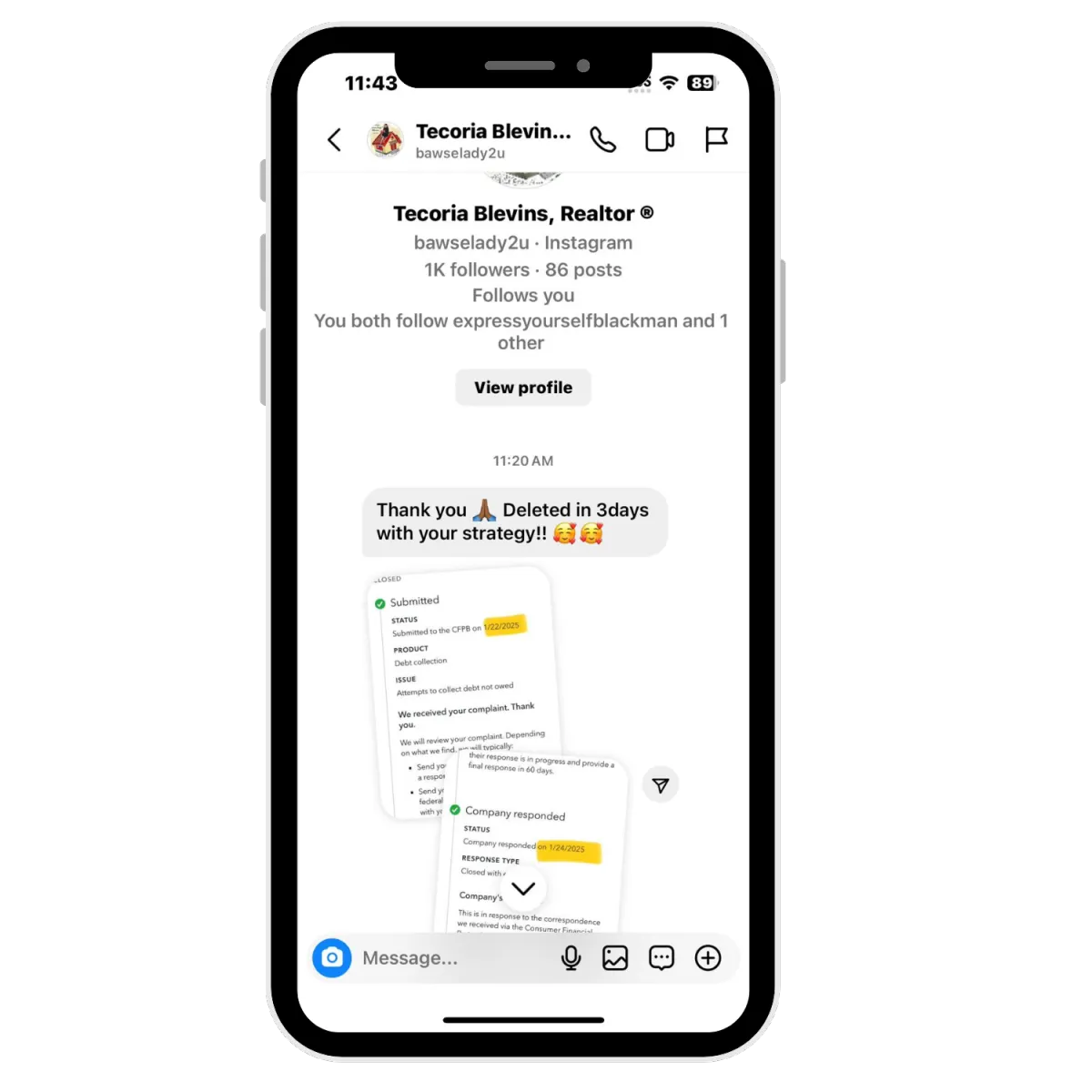

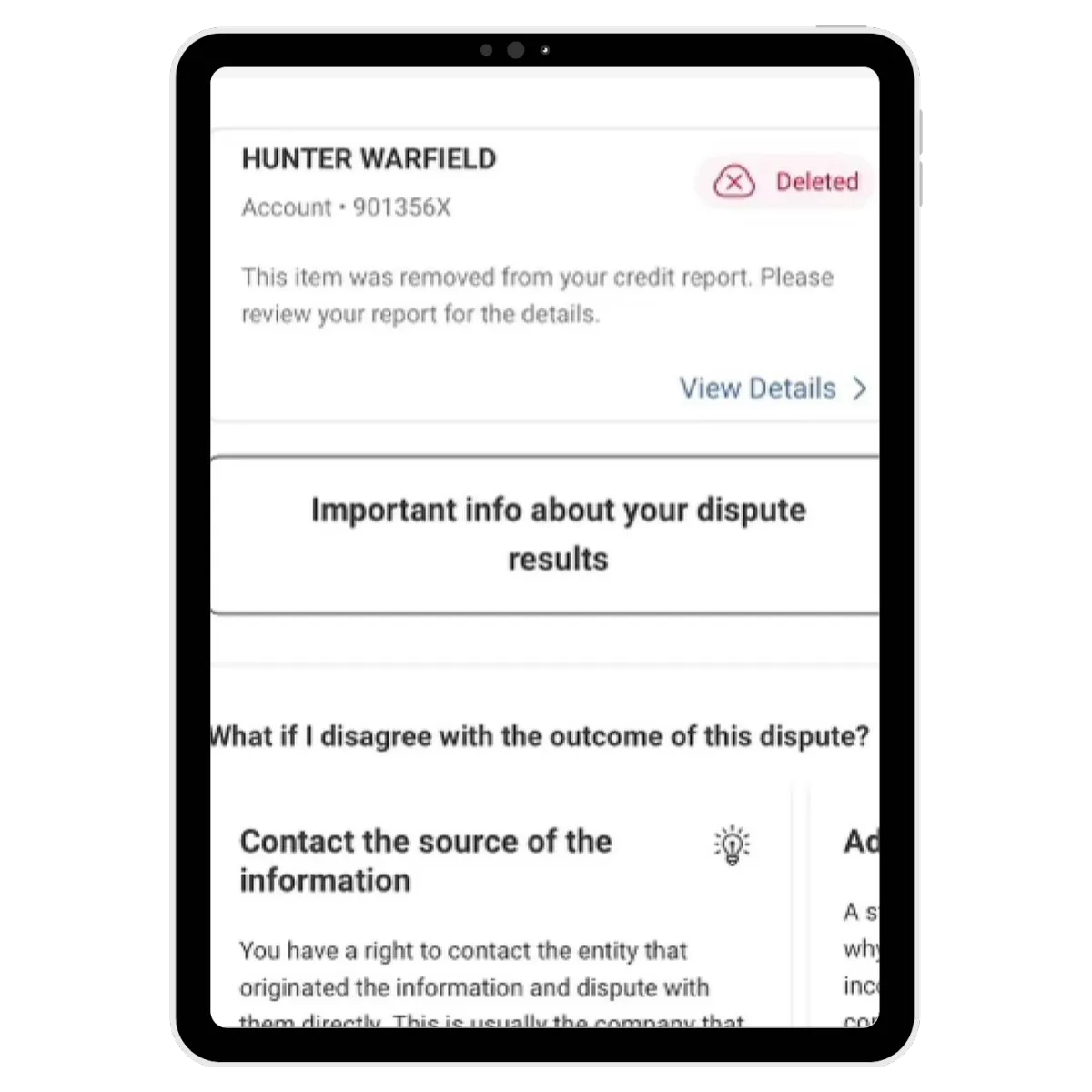

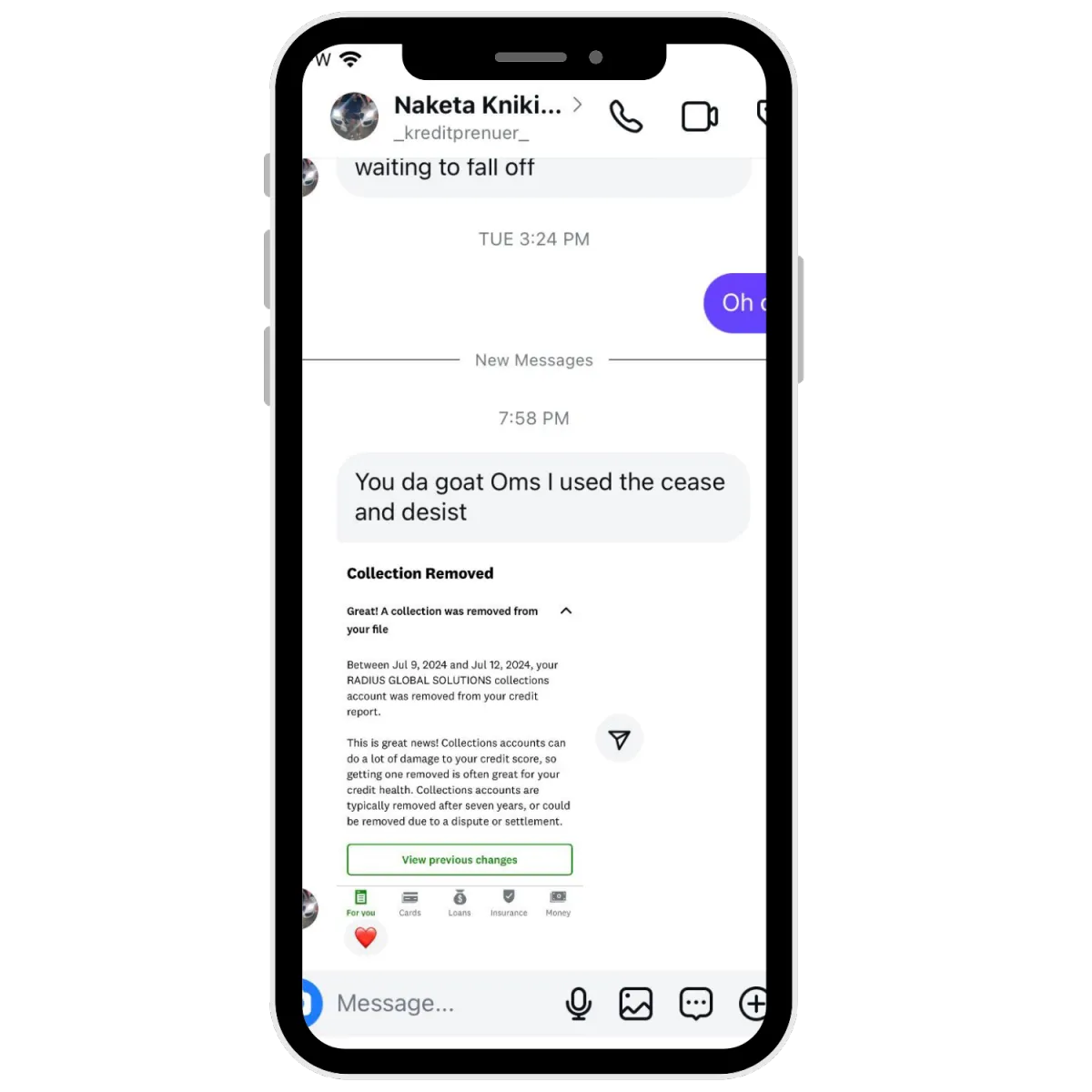

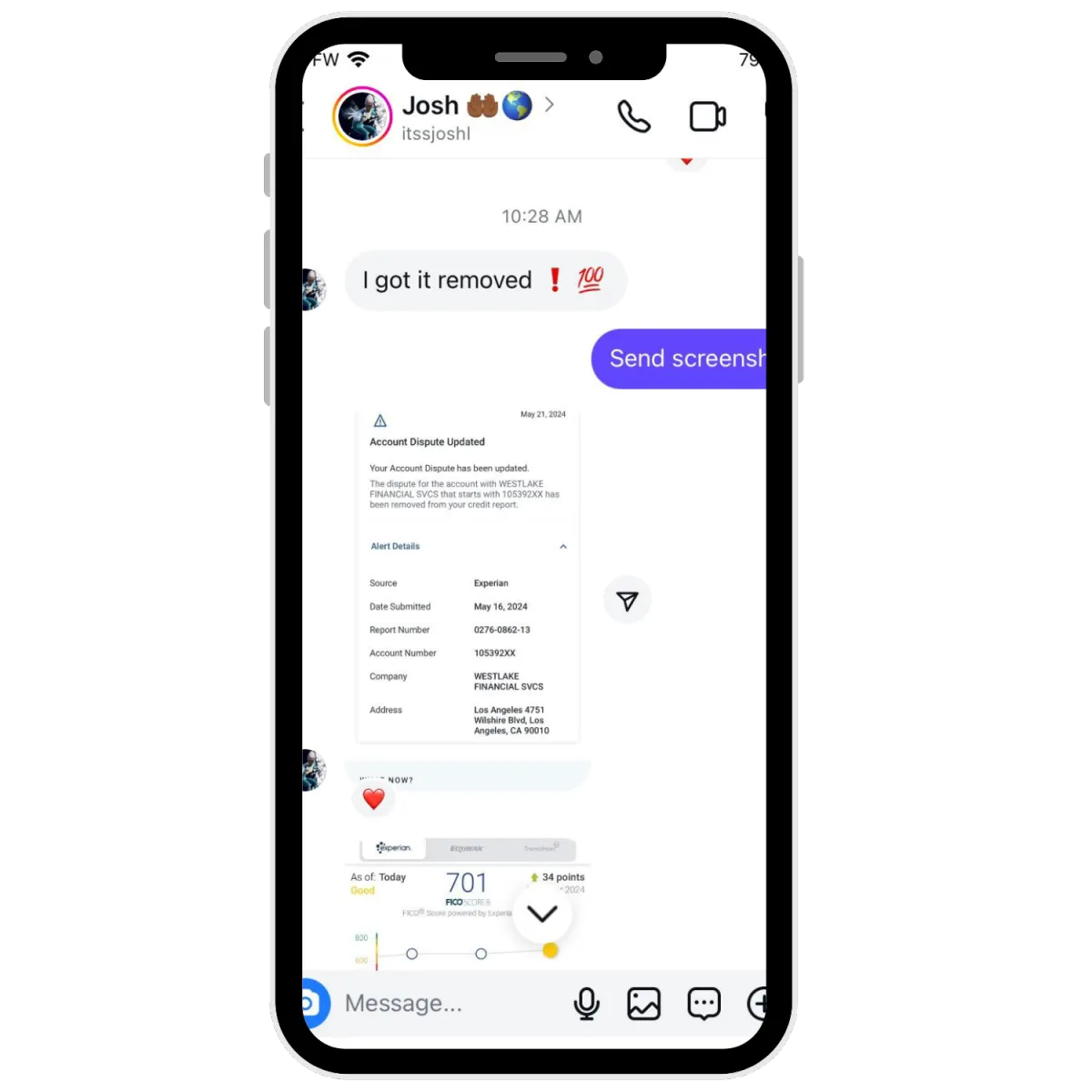

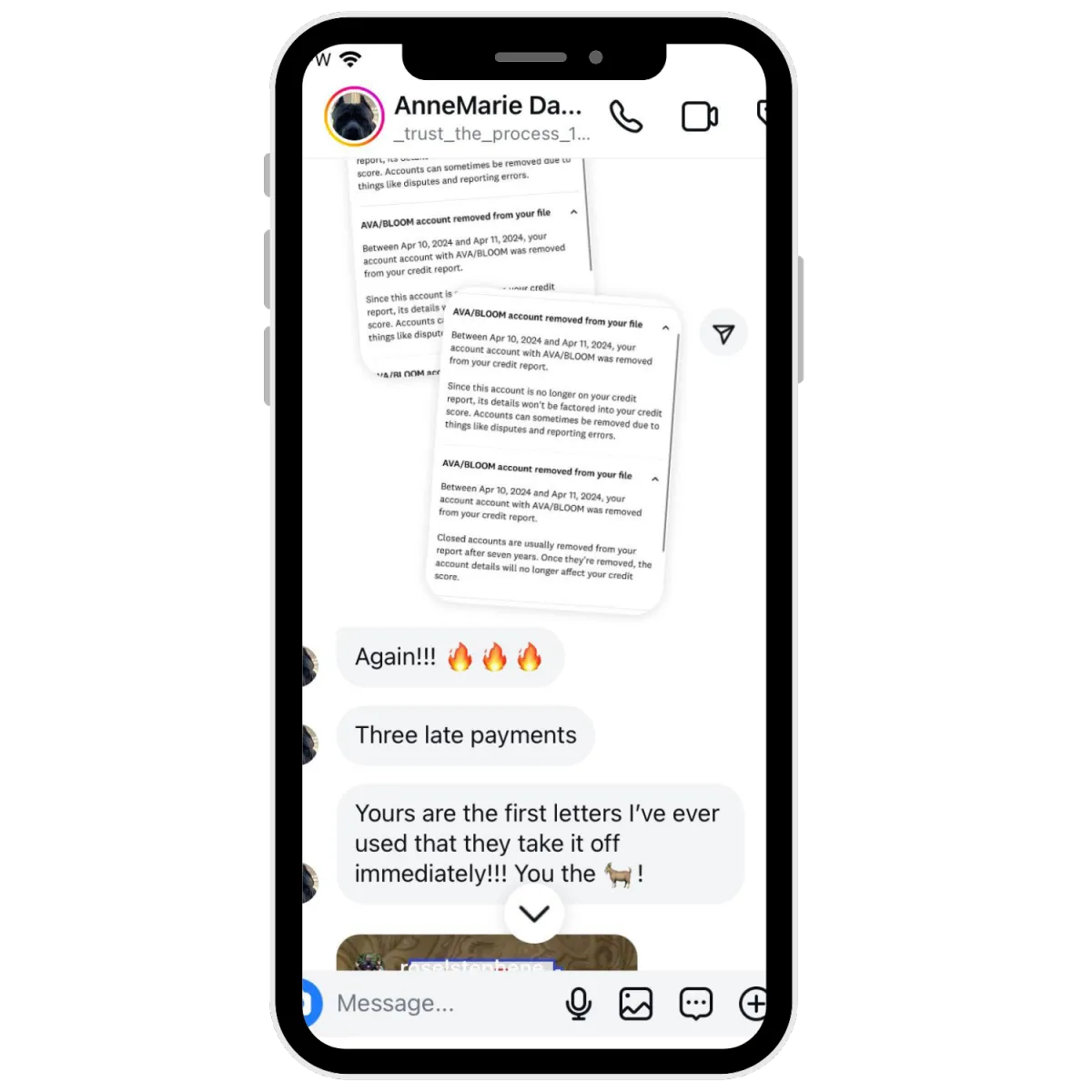

Client Testimonials

Copyrights 2025 | Stephene Enterprise LLC™ | Terms & Conditions